This blog is going to be dedicated to all things macroeconomics, so if you are looking for a fun time, this is your place to be!

First of all, what in the world is economics?!

Based on dictionary.com economics is the branch of knowledge concerned with the production, consumption, and transfer of wealth.

In simple terms, it is

supply and demand

Because economics is so important in our society, it is even split into two sub groups! Microeconomics and Macroeconomics! Macroeconomics is the study of the major components of the economy (international trade, inflation, wage laws, etc.) while Microeconomics is the study of how households and firms make decisions and how they interact in the marked (supply and demand, market structures, etc)

If you haven't guessed already, I will only be discussing the broader aspects,

MACROECONOMICS!

When dealing with economics, there are

two types,

POSITIVE VS. NORMATIVE

Positive economics attempts to describe the world as

is and is very descriptive in nature

- An example would be: Minimum wage laws cause unemployment

Normative economics are claims that attempt to prescribe how the world should be

- Example: The government should raise the minimum wage

It is also important to be able to distinguish between

WANTS VS. NEEDS

Wants are desires, they are broader than needs while

Needs are basic requirements for survival

- In our society, where so many are privileged, it is often difficult to discern between the two

The image above shows how many of us determine these two concepts!

*THE MOST FUNDAMENTAL ECONOMIC PROBLEM THAT A SOCIETY FACES*

Scarcity!!!! This is when one tries to satisfy unlimited wants with limited resources

- Example: gas, coal; essentially nonrenewable resources because you cannot make any more

But don't get this confused with Shortage, which is when quantity demanded is greater than quantity supplied.

- Example: laptops, foods; things that can be made more with time

GOODS VS. SERVICES

Goods

- Capital goods - items used in the creation of other goods (trucks, factory machines)

- Consumer goods - goods that are intended for final use

- Tangible commodities

Services

- Work that is performed for someone else

FOUR FACTORS OF PRODUCTION (This is important!)

- Land - natural resources

- Labor - Work exerted

- Capital

- Physical: Human made objects used to create other goods (buildings, tools)

- Human: Knowledge and skill a worker gains through education and experience

- Entrepreneurship - risk-taking, innovative

Production Possibilities Graph (PPG)

What are PPGs? They are graphs that show

alternative ways to use resources

Other could be referred to as:

- Production Possibilities Curve (PPC)

- Production Possibilities Frontier (PPF)

Here is a look of what one looks like!

As you take a look at the graphs, it is important to realize what they describe. Some important terms to become familiarized are:

Opportunity cost: The most desirable alternative given up by making a decision

Productive efficiency: Producing goods at the lowest cost, allocating resources efficiently, full employment of resources

- Represented by any point on the curve

Allocative efficiency: Combination of the most desired products of society or those in chanrge of economic decisions

Now that we have those terms down, let's talk about the graphs!

They are

concave down based on the 4 assumptions of:

- Fixed technology

- Fixed resources

- Full employment and production efficiency

- 2 products are being considered

When the PPC shifts:

- To the right (outside PPC)

- Technological advancement, discover new resources, trade, economic growth

- To the left (inside the PPC)

- Decrease in labor, work field, education; Permanent lost of productive capacity (war, taxes, government regulation)

- Along the PPC

- Ceteris Paribus: everything remains constant

Demand and Supply

Demand

- Quantities that people are willing and able to buy at various prices

The Law of Demand - Inverse relationship between price and quantity demanded

This graph shows that inverse relationship

Causes of "change in demand"

- Change in number of buyers

- Change in buyer's taste

- Change in income

- Change in price of related goods

- Change in expectation

Supply

- Quantities that producers or suppliers are wiling and able to produce/sell at various prices

Law of Supply - Direct relationship between price and quantity

This graph shows the direct relationship

Causes of "change in supply"

- Change in technology

- Change in weather

- Change in resources/factor prices

- Change in taxes/subsidies

- Change in number of suppliers

- Change in expectations

Elasticity

Elasticity of Demand - measure of how consumers react to a change in price

- Elastic Demand - demand that is very sensitive to a change in price (Always > 1)

- Inelastic Demand - demand that is not sensitive to a change in price (Always < 1)

- Unitary Elastic - Always = 1

How to calculate Elasticity:

- (New quantity - Old quantity) / (Old quantity) = % change in quantity demanded

- (New price - Old Price) / (Old price) = % change in price

- PED = (% change in quantity) / (% change in price)

Production Costs

Total Revenue = Price * Quantity

- The total amount of money a firm receives from selling goods and services

Fixed Costs - cost that does not change no matter what is produced (salary, mortgage, etc.)

Variable Costs - cost that fluctuates or changes depending upon how much is produced (water bill)

Marginal Cost/Revenue - cost of producing one additional unit of good

- New Total Revenue - Old Total Revenue

Total Cost= fixed cost + variable cost

Other important computations you need to know!

- AFC = TFC / Q (Average Fixed Cost = Total Fixed Cost / Quantity)

- AVC = TVC / Q (Average Variable Cost = Total Variable Cost / Quantity)

- ATC = TC / Q (Average Total Cost = Total Cost / Quantity)

- ATC = AFC + AVC (Average Total Cost = Average Fixed Cost + Average Variable Cost)

Another important concept to economics is

price floors and

price ceilings!

The picture below indicates how each is affected by supply and demand,

equilibrium being the point in which both lines meet.

Cycle Graphs

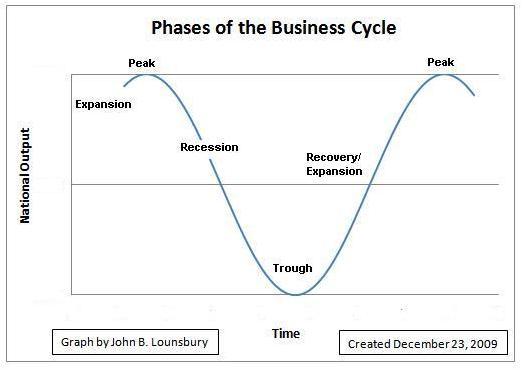

These next types of graphs demonstrate how the economy fluctuates through time.

- The average cycle is 6 years

- Recessions last about 14 months

- The bulk of the cycle is the growth stage

- Peak and trough are meaningless because we never know when we are in one until it's over

- If a recession loses more than 10% of real GDP, hen it is a depression

- Trough means end of a recession

One business cycle is TROUGH to TROUGH