1. Command - Centrally planned, the government owns land and capital, and controls labor

- Cuba (government controls every facet)

2. Traditional - Based on rituals, habits, and customs. Most decisions are made by the elder

- Tribes

3. Free Market - People and firms act on their own best interest. Allows buyers and sellers to exchange goods and services

- Hong Kong

4. Mixed - Government regulates businesses to protect the public's interest

- U.S., Canada, Mexico

- What goods and services should be produced?

- How will these goods and services be produced?

- Who will consume these goods and services?

Markets: Institution or a mechanism, allowing buyers and sellers to make trades (borrowing or paying)

- Product Market - Buyer is usually a consumer and the seller is a firm

- Factor Market - Factor of productions (CELL)

- Most important is labor

- Buyer = firm; sellers = factor owner

- If firms/businesses demand resources = Factor Market

- Customers buying products = Products Market

Households - Person or group of people that share their income

Firms - Organization that produces goods and services for sell

Gross Domestic Product (GDP)

- Total value of all final goods and services produced within the country's borders within a given year

- Includes: All production or income earned within the U.S. by U.S. and foreign producers

- Excludes: Production outside of the U.S. even by Americans

Gross National Product (GNP)

- Total value of all final goods and services produced by Americans in a year

- Includes: Production or income earned by Americans anywhere in the world

- Excludes: Production by non-Americans even in the U.S.

Calculating GDP

GDP = C + Ig + G + Xn

- C = Personal Consumption - purchases of finished goods/services

- Consumption spending

- Ig = Gross Private Domestic Investment - Investment spending

- New factory equipment

- Construction of housing

- Factory equipment maintenance

- Unsold inventory of products built in a year

- G = Government Spending - gov't purchase of goods/services

- Xn = Net Exports (Exports - Imports)

- French company purchases one-year membership at Partypeople.com, U.S. based company

Items that DO NOT count in GDP

- Gifts or transfers (Scholarships)

- Stocks and bonds

- Unreported business activities (Cash tips to waiters)

- Illegal activities

- Financial transactions between banks

- Financial transactions between banks and businesses

- Intermediate goods (what you use to make a certain product)

- Non-market activities (Volunteering or baby sitting)

Expenditure Approach - Income generated from production of goods/services

- C + Ig + G + Xn

Income Approach - All income generated from production of final output

- W + R + I + P

- W = wages, R = rents, I = interests, P = profits

Both sides have to equal!

Net National Product (NNP) = GNP - Depreciation (consumption of fixed capital)

Net Domestic Product (NDP) = GDP - Depreciation

National Income (NI) - Income earned by American owned resources, whether here or abroad

- NNP - Indirect Business Taxes (IBT)

- CE (compensation of employees) + RI (rental income) + II (interest income) + CP (corporate profits) + PI (proprietor's income)

- GDP - IBT - Depreciation - Net foreign factor payments

Disposable Personal Income (DPI) = NI - HT (household taxes) + GTP (government transferred payments)

Real GDP - Measures GDP in constant dollars, is adjusted for inflation, therefore it reverts to base year prices

Nominal GDP - Measures GDP in current prices, regardless of output

- P * Q = NGDP

GDP Deflate - Measure of the level of prices of all new domestically produced final goods/services in an economy

- (Nominal GDP / Real GDP) x 100

Inflation Rate - Rise in the general level of prices

- [(Price index in year 2 - Price index in year 1) / (PI in year 1)] x 100

Consumer Price Index (CPI) - Most widely used measure of the overall price level in the U.S.

- (Price of market basket in particular year / Price of same market in different year) x 100

Inflation - Rise in general price level (standard rate is 2-3%)

Deflation - Decline in general price level

Disinflation - Occurs when the inflation rate declines

Solving Inflation Problems

Rule of 70 - How many years it will take to double inflation (70 / inflation rate)

Real Interest Rate (cost of borrowing/lending money that is adjusted for inflation

= Nominal interest rate - inflation (unadjusted cost of borrowing and lending money)

Causes of Inflation

- Demand-pull: caused by an excess of demand over output that pulls prices upward

- Sources:

- Increases in government purchases

- Excessive increases in the money supply which creates a situation of hyper inflation (rapid rise/extremely high inflation rate)

- Rise in income as the economy approaches FE output (as workers earn more, demand increases)

- Cost-push: caused by a rise in per unit production due to increasing resource cost

- Sources:

- Supply shocks (dramatic rise in energy or raw material prices due to input shortages/growing demand for inputs)

- Price wage spiral (workers seek higher wages to offset rising consumer prices)

Effects of Inflation

- Anticipated - expecting, waiting for inflation

- Increases nominal cost of borrowing while unexpected reduces the real cost of borrowing

- Unanticipated - has stronger effects because those expecting may be able to adjust their work/spending to avoid/lessen effects

- Wages and penchants may have cost of living adjustments (COLAS) built in to offset anticipated inflation

- Hurts those with fixed incomes, savers, and lenders

- Helps borrowers (debt repaid in cheaper dollars)

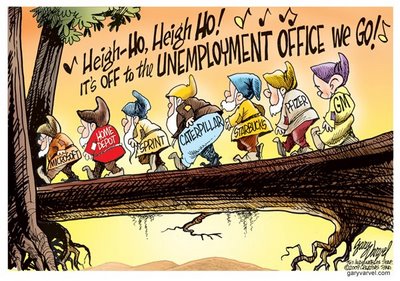

Unemployment

- Unemployment - failure to use available resources

- New entrants, laid off, fired, quit, rentrants

- Employed includes self-employment

- Not included in the labor force -

- Armed forces, homemakers, students, retirees, disabled people, discouraged workers, prisoners, and mental patients

- Unemployment rate = (# of unemployed / # of total labor force) x 100

- Standard unemployment rate = 4-6%

- Four types of unemployment

- Frictional - temporary, transitional, short-term

- In between jobs/searching for job

- Graduates, fired/quit jobs

- Signals that new jobs are available

- Cyclical - caused by the recession phase of the business cycle

- Deficient demand for goods/services

- Structural - technological or long-term

- Automation - due to consumer taste, jobs may become obsolete

- Creative Destruction - New jobs are created, others are lost

- Seasonal - weather related of seasonal jobs

Full Employment (FE) = Natural rate of unemployment (NRU)

- It is equal to structural and frictional unemployment

- Full employment does not mean zero unemployment

Okun's Law

- Describes how unemployment relates to a nation's GDP

- States that for every 1% unemployment above the NRU, a negative GDP gap of 2% will occur

Unequal Burdens of Unemployment

- Rates are lower for white collar workers

- Teenagers have the highest rates

- Blacks have higher rates than whites

- Rates for males and females are comparable